Understanding Value

You might see a home’s value differently than I do, or differently than the market does. So when we talk about value as it pertains to a house, we are only concerned with market value, which is closely tied to appraised value. The primary purpose of this book is to help you determine what improvements to make to see the highest return in market value. We refer to this as ROI (return on investment). The first concept we need to understand about renovation ROI is that it is context dependent. Nobody can tell you in absolute terms what improvements will net the highest return without a thorough understanding of the variables. Generally speaking, when you make an improvement to a house, the amount of value it adds can easily be outpaced by the hard cost of the renovation. This is the core principle behind renovating for profit. You need to know what to do, and how much to do, to maximize the increase in value.

For example, let’s say you install a $50,000 kitchen. That doesn’t mean you added $50,000 of value. Why is that? There are two important factors to consider with every improvement you make.

- Over improvement: The law of diminishing returns determines that there is a point where increasing input leads to smaller and smaller increases in output. Every house has an upper limit to its potential selling price. That limit is determined by what similar houses in the area are selling for, what new construction in the area costs, and what the local economy can support in terms of buyer income. As you close this gap, from your current value to the upper limit, the weaker points of your house will drag on the market value. Buyers are far less likely to overpay for a house with a jaw dropping kitchen when they can buy a house with a kitchen that is good enough, but the house is newer, larger or every other part of the house is in better shape. You must be aware of this ceiling. The renovations you make need to be appropriate for the given market. Anything above the standard will yield a diminished return in overall value of the house.

- Existing Intrinsic Value: Each part of the house has intrinsic value, even if it is outdated. If something is functional, it has value. You may have installed a $50,000 kitchen, but the existing kitchen from the 90s was still working. To the market, it may have represented $20,000 of value. So the net increase you see is reduced because of the intrinsic value of what you replaced. In effect, part of what you paid on the initial purchase of the property is assignable to these outdated yet functional features of the house. If the kitchen wasn’t functional, the bathrooms didn’t work, and the windows were broken out, it’s fair to say the house would have sold for much less. So unless you paid under market value, or these features are completely defective, there will be less of a margin to capitalize on.

In this book we will talk about value in 3 ways:

Appraised value: Appraised value is the estimated market value of a property as determined by a licensed appraiser. It reflects what a typical buyer would likely pay for the home under normal market conditions, based on factors like the property’s size, condition, location, comparable sales, and any amenities or features. Appraised value is used by lenders to guide loan amounts, by buyers and sellers to set prices, and by tax authorities for property assessments. It’s not the same as the purchase price—sometimes the market will pay more or less than the appraised value.

Market value: Market value is the price a property would sell for on a fair and open market under normal conditions. It represents the amount a willing buyer and a willing seller would agree on, both acting knowledgeably and without undue pressure. Market value reflects supply, demand, and comparable sales rather than the cost to build the home or the seller’s personal expectations. While the exact market value is only confirmed after a sale, it can be reasonably estimated using comparable properties.

Marketability: Marketability is the ease with which a property can be sold on the open market at or near its market value. It reflects how attractive the property is to potential buyers, with an emphasis on psychological appeal. Highly marketable properties typically sell faster and on better terms because they are more competitive. Marketability matters most in high supply, low demand markets, which is why sellers are often advised to make their homes stand out. In low inventory markets, however, marketability becomes less important—when a property is one of the few available, standing out by price is far more effective than relying on high cost, low value cosmetic improvements.

Roles and Goals

Before planning your project, you must determine your role in the renovation. For simplicity’s sake, we will break this down into two categories.

- Investor: Most investors rely on purchasing a property below market value. This gives them a larger margin for improvements. If there is abundant inventory in their market, the value of the house may benefit from standing out with higher quality improvements. The house may also sell faster, which means lower holding costs and more leverage in negotiations. If there is low inventory in their market, they may need to do less to capitalize on lower quality standards, and the house may sell quickly regardless of an overly ambitious or conservative listing price. They may have lower standards for profit margins as well, because their system allows them to manage multiple projects at once. The investor’s approach should be standardized with a focus on speed and efficiency. The investor relies on building relationships with subcontractors and strict budgeting to achieve a predetermined return.

- Homeowner: When homeowners make improvements for ROI, the primary advantage should be a reduced cost basis. The initial cost of the home may be lower if they have owned it for years or inherited it. They may even have a cushion of equity built in. There is also a lack of time decay on the project, especially if you live in the house you are renovating (though there are efficiency trade offs). A homeowner needs a place to live anyway, so the mortgage is simply part of normal living expenses. An investor, on the other hand, often has an interest only loan in the four figure range, plus additional property taxes, utilities, and insurance. A homeowner can also directly lower the cost of renovations in several ways. The most impactful is by providing free labor. You can’t expect to make a fortune by working on your own house. Many tasks are menial, low skill, and will take you longer than a professional. But there are some high dollar items where doing the work yourself can reduce the realized cost significantly. Even if the homeowner isn’t providing much labor, the ability to manage the project over a longer timeline is a benefit on its own. That’s more time to assess the work, stage and prepare for tasks, and to find the best deals on material and labor. This is just as impactful as anything else and should not be understated. You can cover the value of a day’s labor simply by finding a $200–$300 material discount. A homeowner may be able to list higher in any market, if they are comfortable sitting on the house while waiting for a buyer. The homeowner may see more benefit to their bottom line by aiming for the very top of the local market, if they can afford to be patient.

It’s important to identify which role applies to you so you can maximize your advantages and set realistic goals. Are you aiming to sell quickly and earn a specific monthly return while your funds are tied up? Do you want to increase your home’s appraised value to pull out equity? Or are you simply looking to make smart improvements that will position you better when you eventually sell? All of these are valid objectives, and they should guide every major decision you make during the renovation process.

Regardless of your role, if your goal is to maximize appraisal value with no plans to sell, adopt a conservative approach. Focus on doing less to achieve more margin. You aren’t renovating to impress buyers, so your goal is to meet the minimum standards required for the highest tier of value. You won’t add extra value by choosing herringbone tile over a 50/50 stagger, or by buying premium brand fixtures.

Seasonal Swings

If your goal involves selling the house once the renovations are complete, it would be a mistake not to give consideration for the time of year you list the house. The MLS (multi listing service) is a centralized system for current and historical property listings in any given area, which allows me to pull data for visualizations and analysis.

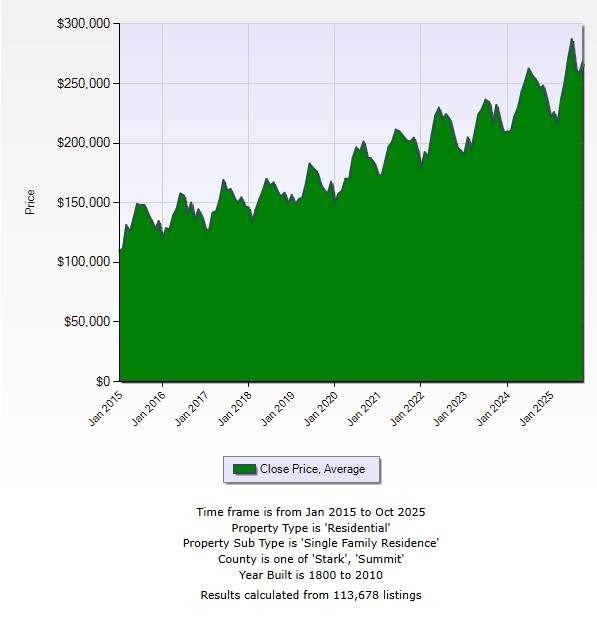

Figure 1.2.1 shows the average home sales price over the past ten years in Stark and Summit counties in Ohio. The data is grouped by month, and a clear seasonal pattern appears: prices peak in the summer months and dip in the winter (typically December through February). In some years, the fluctuation is as large as 25%. This indicates that homes generally sell for less during the winter season.

Similar data on average days on market supports the same conclusion, when homes take longer to sell, sellers are more likely to reduce price when they can. With this in mind, it’s advantageous to list a property during the months that favor sellers in order to maximize its potential market value.

Figure 1.2.1

Size Matters

When outlining your renovation plan, it’s important to consider the size of the home. Many people focus on the price per square foot, but this is a largely misleading metric and not a reliable way to compare home values. As a house increases in size, its price per square foot naturally decreases. The reason is simple: most homes share fixed cost components, one HVAC system, one kitchen, a set number of bathrooms, a single laundry area, and similar plumbing and mechanical demands. Increasing square footage doesn’t necessarily add proportional cost to these systems.

However, some aspects are directly tied to square footage, and these should be factored into your renovation budget. The most relevant are demolition, flooring, drywall, paint, trim, windows, and doors.

There is a practical “sweet spot” for renovations aimed at maximizing ROI: a home large enough to attract a broad buyer pool (at least three bedrooms) but not so large that renovation costs become excessive or the final price pushes buyers out of the market. In my area, that ideal range is typically 1,200-1,800 square feet with 3-4 bedrooms and 1-2 bathrooms.

Market Conditions

Real estate markets are highly localized. One region may be a seller’s market with limited inventory, while another may be a buyer’s market with an oversupply of homes. In my area, northeast Ohio, there is currently a significant inventory shortage. This shortage has reduced the availability of affordable housing and shifted buyer priorities toward price above all else. As a result, overall quality expectations have dropped, and the cost of “affordable” homes has increased.

At the same time, renovation costs have continued to rise, making profitable returns harder to achieve. In many cases, it is more cost effective to sell a property as a livable fixer rather than invest heavily in upgrades for only a marginal increase in resale price. We’ve tested this repeatedly, and sellers have consistently benefitted. If your home already has average or better finishes in a market like this, you may be better off selling or appraising it as is. This is not universally the case nationwide or even across all price ranges, so this should be determined on a case by case basis.

The working theory is that buyers are now willing to overpay for fixer uppers simply to secure a home. Many underestimate the true cost of repairs and assume they can renovate gradually over time. As they compete against one another, the prices of homes in moderate disrepair get pushed beyond the point where a renovator can achieve a profitable margin based on the market’s ceiling value. The home still needs to be reasonably functional to qualify for financing, but that’s all that’s required. Meeting basic loan standards ensures the widest possible buyer pool.

Market Research

So what should I replace if there is such a constrained margin? There is no simple answer, but building your frame of reference will help you decide what, if anything, is appropriate for you to renovate. The most important factor in determining the renovations will be the local market. When the specific home market is high dollar, it’s easier to justify more cosmetic updates to meet the standards of buyers in that area. The lowest markets simply can’t support the cost of extravagant updates. It’s too easy to eclipse the top end of what the neighborhood can fetch. Meanwhile, a lakefront home in an affluent area expects a minimum quality standard on finishes at a certain price point. It is important to know where your house fits in the local economy.

Unfortunately, most people don’t have direct access to the MLS to run professional comparables. Zillow can serve as a reasonable substitute, but avoid relying on the Zestimate, which is notoriously unreliable and often joked about among real estate professionals. Instead, focus on searching for sold homes in your area to gauge the current and potential value of your home. Keep in mind that real estate photos can be misleading. In my experience, no house looks as good in person as it does online. Public listings also omit broker remarks about potential serious issues, so if a home seems out of line with its peers, there’s likely an underlying problem you won’t see. As you review comparable homes, pay attention to finishes. Carpet that isn’t listed as new is often worn or smells, and damaged walls or other defects may be edited out of photos. Over time, viewing and visiting enough listings helps you develop a discerning eye, helping you to assess a home’s true condition. This skill is essential for establishing a realistic baseline value, so I encourage you to visit every open house you can and watch what the house ultimately sells for.

When comparing homes, it’s crucial to compare apples to apples. Focus on properties that are within +/- 200 square feet, have a similar number of bedrooms, +/- 1 bathroom, comparable architectural style, and similar lot size. Other features to consider include garages, a finishable basement, and the overall neighborhood style.

As you evaluate homes, ask yourself:

- Is the property on a busy road, and is that typical for the area?

- Is the age of the house an outlier in this market?

- Are there nearby commercial or industrial structures that could be a nuisance—or a benefit?

- What is the general condition of the surrounding homes?

- How does the school district compare to those of similar homes?

These questions are a starting point; many other factors may also influence value. To get a reliable estimate, you need multiple comparable properties to support a number, whether it’s the current value or the potential value. If local sales data is limited, you may need to expand your search geographically. Rely on actual sale prices rather than listing prices, as the sale price is the most accurate indicator of value.

Current Value vs. Potential Value

Using these techniques, you can establish both the current and potential value of a home. In markets with limited inventory, it can be advantageous to price slightly below the top of the potential value range. This approach often allows for similar profit margins while attracting more buyers and selling faster. Your pricing strategy should always be dictated by your local market conditions and research.

If you’ve just purchased the property, your current value estimate may be based on the purchase price, assuming you didn’t overpay or underpay, both of which are possible. Your margin should still be factored off the current value. If you underpaid, the equity would represent the profit you already possess. If you underpaid by $20,000 because you got a good deal, then your ARV (After Repair Value) needs to generate more than $20,000 in profit for the renovation to be worthwhile.

If you overpaid, then you have a deficit. Assuming you overpaid by $20,000, if you perform renovations and sell the house at break even on your cost basis, your renovation ROI has actually improved your position by $20,000. This is how you need to consider your position to make the proper decisions.

If you overpaid: You may need to be more frugal with renovations, contribute your own labor, or explore other options to capitalize on the deal. Alternatively, you could cut your losses and move on to save time.

If you underpaid: You may have the opportunity to sell the house without renovations and capture the existing margin. Some companies, often called wholesalers, operate entirely on this model. While some of their practices may be ethically questionable, a good deal can be a valuable opportunity. Carefully consider all options to maximize your outcome.

You want to determine your potential value realistically. It’s easy to view your own projects through rose colored glasses, so consciously check your optimism. One effective approach is to consider both pessimistic and optimistic scenarios, develop a range, and use the median as your potential value.

Keep in mind that this number can change over the course of the project as more comparables become available, especially for long term projects. Market conditions are always evolving, so the value may move in either direction. For projects lasting a year or more, appreciation can also influence the actual market value when it comes time to sell.